Role: UX Engineer

Project Category: Research, Design, Development

Duration: 8 months

Team Members: 5

Summary: This was the capstone project for CMU's MHCI program. I worked with an interdisciplinary team of five MHCI students to explore financial decision making in the realm of personal banking.

Overview

We set our sights on finding ways to enable mass affluent Bank of America customers to make better, more informed financial decisions. Ultimately, we found a series of tensions in the ways people approach their financial choices. Balancing values with actions is difficult, and the motivation necessary to make the best possible choices can be hard to find. While individual definitions may vary, we found that trust, simplicity, and control are key.

Our Approach

To help Bank of America's customers maker better financial decisions, we sought to understand what constituted financial health and how trust, automation, and the recent recession affected people's openness to receiving help.

Our research began with a literature review of 24 academic articles and white papers, a competitive analysis of products aimed at helping people manage their finances, and exploration of intervention techniques in four analogous domains. Following our secondary research, we recruited 17 participants and conducted hour long interviews with each. Interviews included open-ended questions, directed storytelling, a card sorting activity, and a radar diagram activity followed by a short survey.

Secondary Research: Dissecting Decision Making

Our team conducted a literature review and exploratory research of both direct competitors as well as analogous domains in order to better understand the space of unhealthy decision making.

Our secondary research was driven by three guiding questions:

What influences decision making?

How and why do people make poor decisions, and what kinds of poor decisions do they make?

What motivates people to make better decisions?

Literature Review

Studying various domains through an extensive literature review helped us to gain an understanding of the human nature of the decision making process, and where it can go awry.

From our research, we aggregated 12 biases that play a role in influencing the errors people are prone to while making decisions:

Competitive Analysis

We studied the competition through the lens of managing both income and spending habits, and evaluated tools across domains of savings, investment, debt management, bill payment, and financial education. We found that small companies are taking the biggest risks with innovative financial technology and tools, and it is paying off. While the threat to large banks is small, they are driving higher expectations in the retail banking sector.

Chart from competitive analysis report

Key Takeaways:

Existing tools do not treat finance as part of a holistic individual, but rather as a discrete fragment

A lot of information can be hard to process, so people often try to oversimplify their decisions

It is difficult to fully understand how actions in the present will affect the future

Existing tools often do not provide directly actionable information, or only provide a limited set of options

Primary Research: Understanding the Human Factor in Finance

Our team conducted interviews interspersed with structured activities to better understand where people obtain financial information and how trust influences decision making.

Interviews

We used a flexible structure of both questions and activities, to help build rapport and keep participants engaged. This also allowed us to improvise and cater to the communication style of each participant. Participants were recruited from a range of locations, ages, and income brackets. I wrote the script used in all 17 interviews and lead 3 interviews.

Card Sorting Activity

We also conducted an open card sort, where participants arranged a set of pre-made cards into groups of their choosing and labeled them. As they explained why they chose to group different items together, we found insight into the ways finance fit with other components of their lives. I designed the digital version of this activity used in remote interviews.

Radar Diagramming Activity

In an activity titled What’s On Your Radar?, participants generated sticky notes to illustrate where they turn for financial knowledge, advice, and assistance. The closer these notes were placed to the center of the chart, the more important they were to that individual. I designed the digital version of this activity used in remote interviews.

Guerrilla Research

We spoke with passersby on a busy retail street in Pittsburgh about their sources of financial literacy and assistance. We later recruited two of these passersby for full-length interviews. I was responsible for guiding participants through the activity once they had agreed to participate.

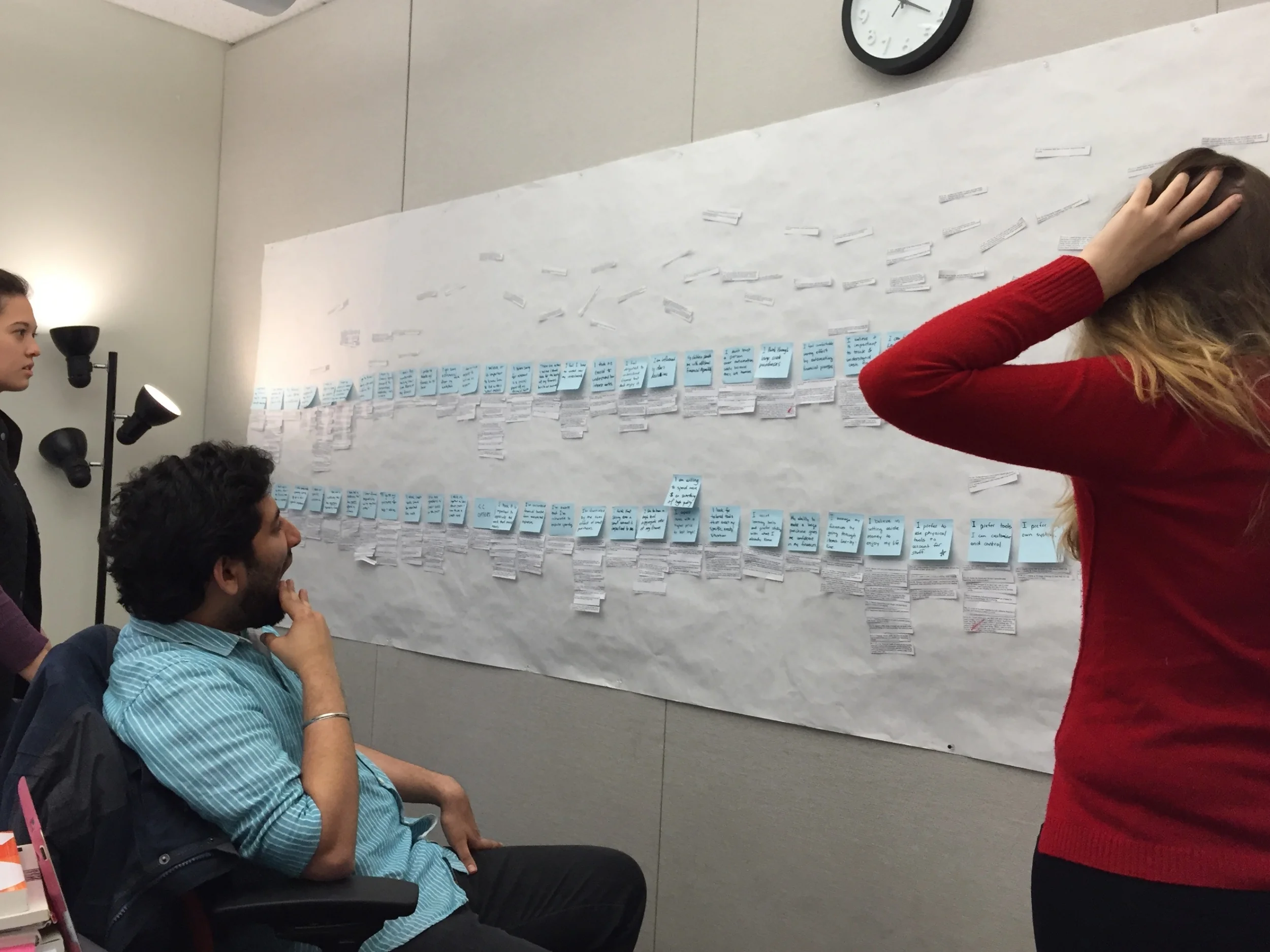

Affinity Diagram Analysis

We sorted and grouped over six hundred notes in an affinity diagram to find patterns throughout the interviews we conducted. Grouping these patterns led to over eighty separate insights into the financial mindsets and situations of our target population. Further abstracting these insights and focusing on the most powerful and impactful items led us to derive a series of key themes as one method of organizing our findings.

Key Insights: Tensions in Financial Values

As themes emerged from our affinity diagram analysis, our team noticed that many insights within these themes were in direct conflict with one another. These conflicts led us to additionally organize our findings by way of a series of powerful tensions, both internally to a single individual, and externally among different groups within our target demographic population.

External Tensions

External tensions result from opposing knowledge, values, and behaviors between separate subgroups within our participant pool. These external tensions are important to consider because they play a role mediating between different perspectives and values within the population as a whole.

Internal Tensions

Internal tensions describe conflict resulting from incongruent knowledge, values, and behaviors within a single individual. These tensions were observed across genders, geographic locations, generations, and income levels. Many of these tensions were not directly acknowledged by participants but came about through our team’s affinity diagram analysis of the data.

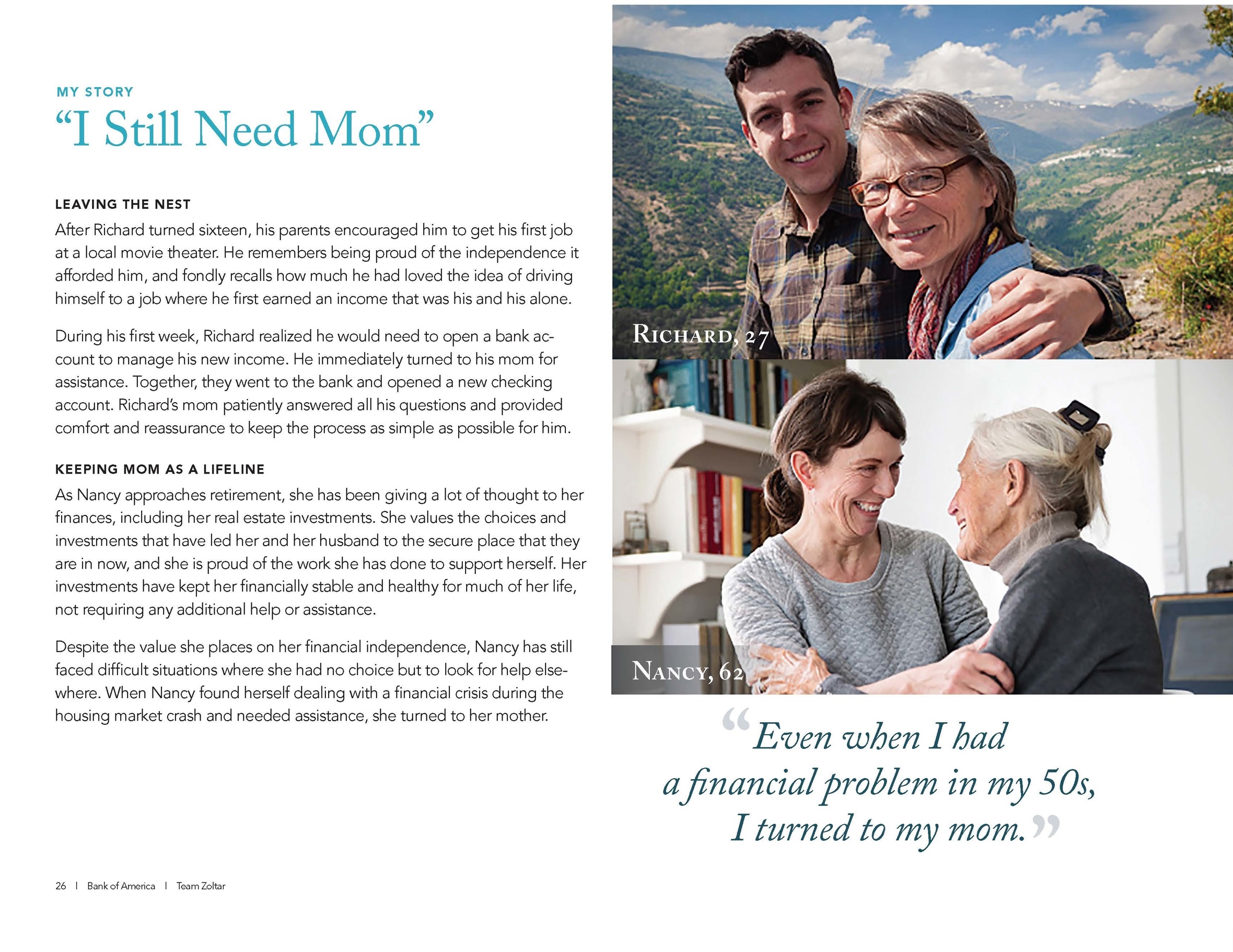

Persona Vignettes

For our clients, we put together a series of persona vignettes to illustrate our findings. These reinforced the tensions we identified and provided concrete examples to bring our findings to life.

Journey Map: Stage of Life Determines Financial Needs

Next Steps

When our team set out, our goal was to help people make better financial decisions. This presented a huge amount of blue sky with intimidating breadth. We focused our scope by attempting to define what an unhealthy decision meant, leading us to explore ideas of trust, control, values, and planning. Using an affinity diagram, we synthesized data from interviews, guerrilla research, and structured activities with participants and studied this in conjunction with academic research and competitive analysis aimed at understanding both decision making and financial technology more generally.

Our findings led us to uncover a series of tensions, both within single individuals and between groups, surrounding the ways people approach their finances and make their choices. With an understanding of these opposing forces, our team is excited to build a solution that delivers value to Bank of America and their customers.

Stay tuned for updates! Our team will be designing and implementing a solution throughout the summer.